hotel tax calculator quebec

Here is how the total is calculated before sales tax. Over 42184 up to 84369.

Sweden Taxation Of International Executives Kpmg Global

If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237.

. Formula for calculating the GST and QST. Over 84369 up to 96866. Amount without sales tax x QST rate100 QST amount.

You can also explore canadian federal tax brackets provincial tax brackets and canadas federal and provincial tax rates. Over 96866 up to 117623. Calcul taxes TPS et TVQ au Québec Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT.

2 tax on hotels with more than 20 rooms in Halifax and area. Nunavut territory GST 5. The TIP is at least equal to the.

Over 42184 up to 84369. That means that your net pay will be 36763 per year or 3064 per month. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

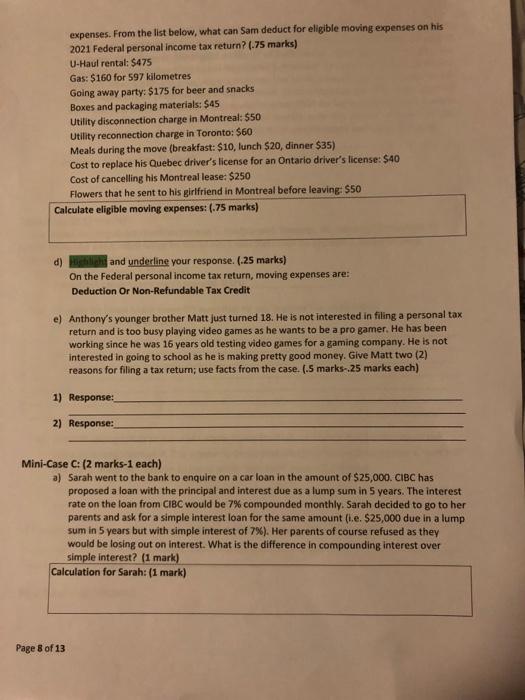

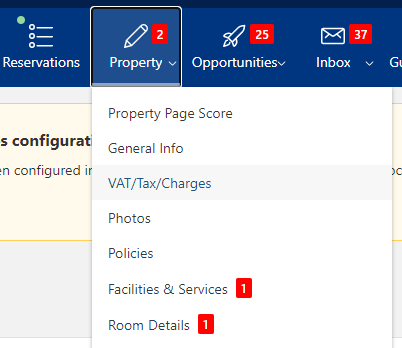

Billing the 35 Tax on Lodging. The calculator include the net tax income after tax tax return and the percentage of tax. Quebecs marginal tax rate increases as.

Calculator to calculate sales taxes in Quebec Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. This total rate is a combination of a goods and services tax gst of 5 and a. About the 2022 Quebec Salary Calculator.

No additional hotel room taxes in Nunavut. Hotel Tax Calculator Alberta. So it would be 100 - 10350 then 518 GST and 1032 in QST for a total of 11900.

More than 109756 2575. Calcul de la taxe sur lhébergement au Québec en 2022. Here is how the total is calculated before sales tax.

Tax rates Less than 15728 0. Amount before sales tax x GST rate100 GST amount. You must calculate the 35 tax only on the price of an overnight stay regardless of anything that is supplied with the sleeping accommodation and regardless.

Over 84369 up to 96866. Calculations are based on rates known as of Oct 31 2022. Quebec tax bracket Quebec tax rate.

Over 117623 up to. Calculate your take home pay in 2022 thats your 2022 salary after tax with the Canada Salary Calculator. If you are paying on meals the total tax would be 14975.

Le TIP est au moins égal à la. Over 117623 up to. Basically 18999125 on hotel rooms.

Facturation de 35 sur le prix de la nuitée 350 de taxe par intermédiaire et TPSTVQ si applicable. The period of reference or the tax. Over 96866 up to 117623.

Quebec tax bracketQuebec. The tax rates in Quebec range from 15 to 2575 of income and the combined federal and provincial tax rate is between 2753 and 5331. Amount without sales tax.

A quick and efficient way to compare. Hotel Tax Calculator Quebec. 2023 tax brackets and credits have not yet been verified to Canada Revenue Agency or Revenue Quebec amounts.

Calculate the total income taxes of a Quebec residents for 2022. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at. Quebec tax bracket Quebec tax rate.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Solved Table A Combined Federal Quebec Tax Brackets And Chegg Com

Try Cbc S Stadium Tax Calculator Cbc News

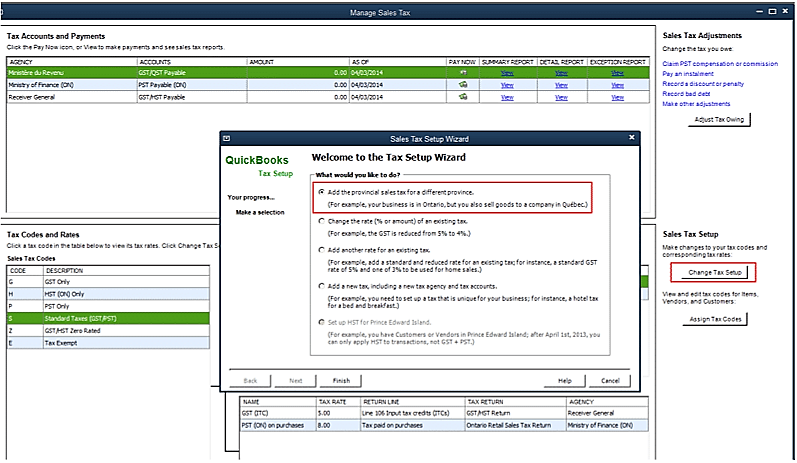

The Small Business Owners Guide To Provincial Sales Tax

How To Audit And Fix Hotel Tax Rates To Save A Few Bucks Hotel Online

Reserve At Quebec Apartments 6655 Calgary Ln Fort Worth Tx 76135 Zumper

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

Calculating Sales Tax It Takes More Than Just Numbers

Bw Premier Hotel Aristocrate Quebec Qc 3100 Ch Saint Louis G1w 1r8

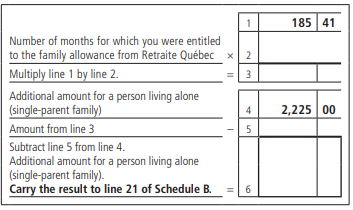

Dt Max Line 361 Age Amount Amount For A Person Living Alone And Amount For Retirement Income

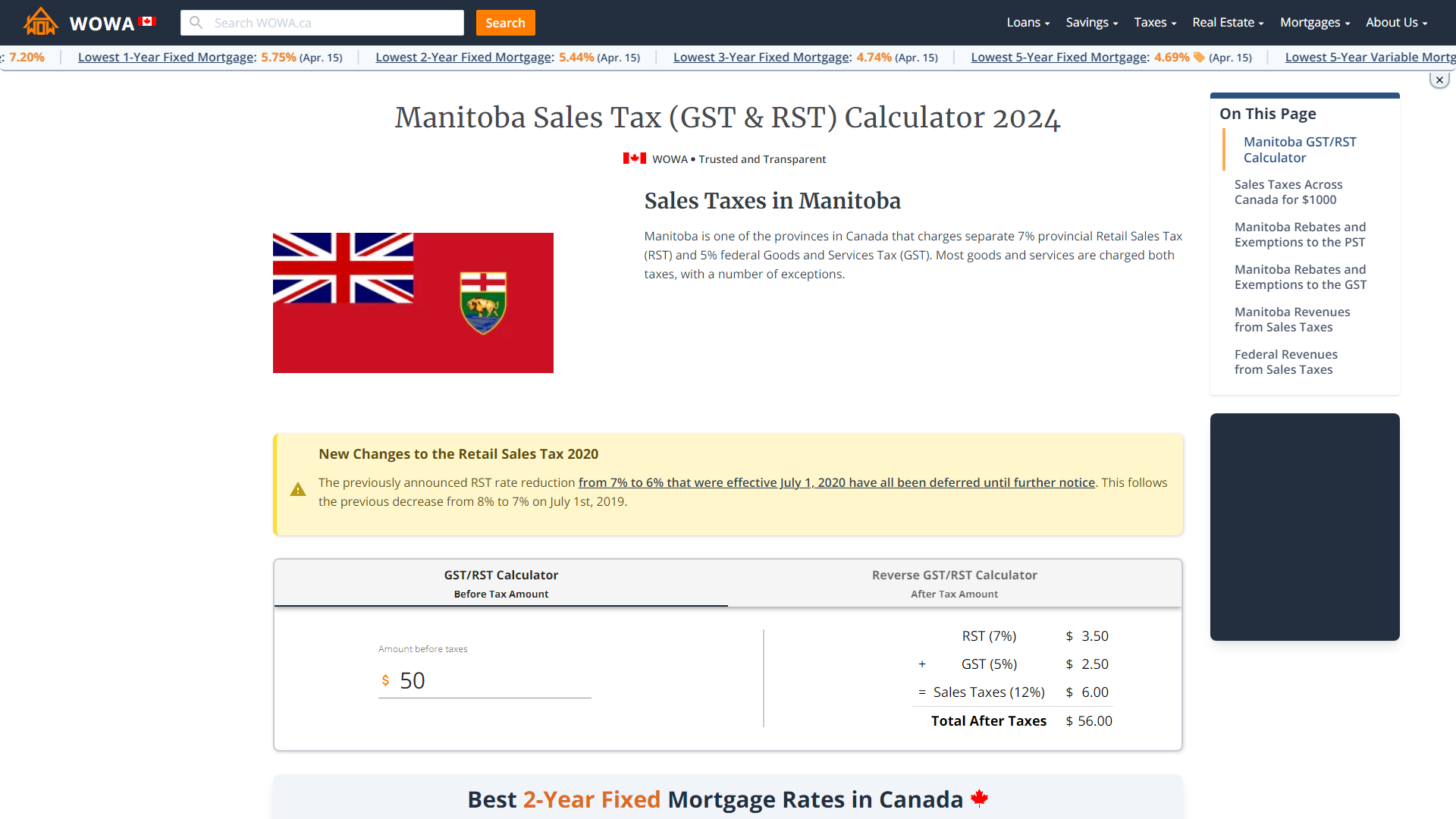

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

How To Audit And Fix Hotel Tax Rates To Save A Few Bucks Hotel Online

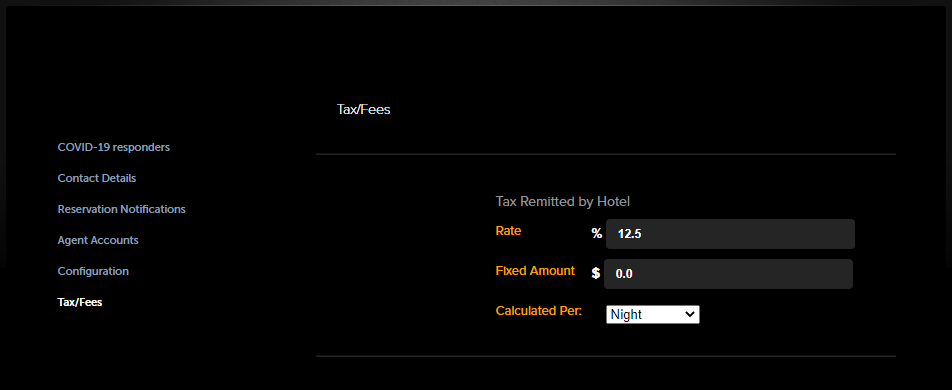

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Nyc Eliminating Hotel Room Occupancy Tax Rate For Three Months Starting In June Travel Weekly

Cost Of Moving From California To Quebec Cost Benefits

Income Tax Calculator Calculatorscanada Ca

What U S Companies Should Know About Selling Goods And Services In Canada

How To Set Up Sales Tax In Quickbooks Desktop

Cra Answers Questions On Graduated Rate Estates Investment Executive