do nonprofits pay taxes in canada

Income Tax Exemption and Tax Treatment of Donations. This sounds like a lot but the cost of video production and tax is also very high.

Don Nonprofit Organization In Canada Have A Tax Id Ictsd Org

Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors.

. Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment. NPOs and registered charities are not subject to income tax. Do Non-Profit Organizations Pay Tax.

Non-profit organizations are exempt from tax under Part 1 of the Income Tax Act for the portion of their fiscal period where they meet the requirements to qualify as a non-profit organization. However they arent completely free of tax liability. It is not necessary to pay property taxes to get nonprofit services from local governments.

In short the answer is both yes and no. Because nonprofits are tax exempt homeowners and for-profit businesses are taxed as if they are helping them provide nonprofit organizations with benefits such as streetlights and police. GSTHST Information for Non-Profit Organizations.

Most are also exempt from state and local property and sales taxes. Responsibilities Skills and Courses for Professional Development 1. In many cases nonprofit organizations and charities do not pay income tax.

Here is a table that shows the tax rates you pay in each band if you have a standard Personal Allowance of 12500. Sales of food meals beverages and similar items under a number of different circumstances. Do nonprofits pay taxes.

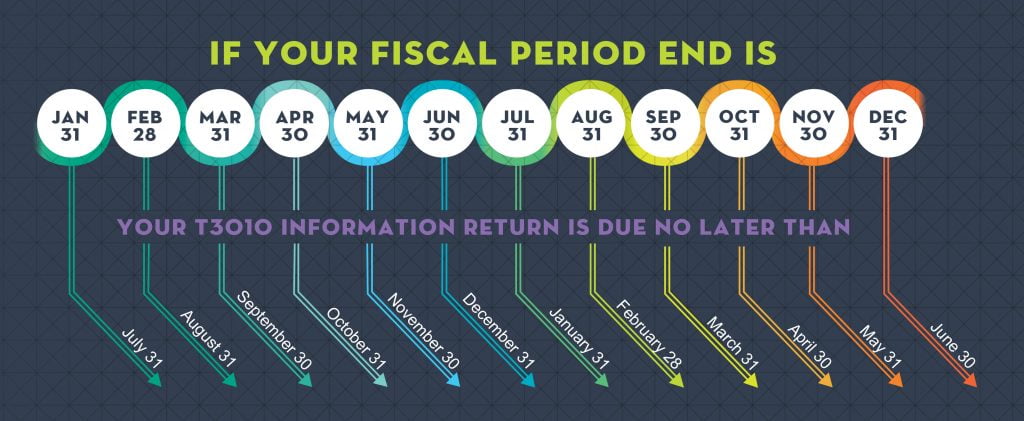

All nonprofits are exempt from federal corporate income taxes. In fact both organizations are forbidden by the CRA to benefit their members in the same way. Not-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency.

Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission. The tax status of real or personal property owned or used by charitable non-profit organizations can get complicated when there are multiple private and public entities involved with the property. If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you.

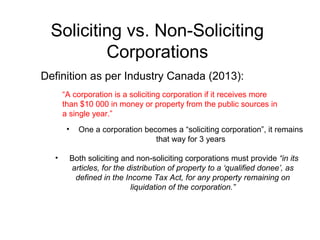

Are Nonprofit Organizations Tax-Exempt In Canada. Charities and not-for-profits ought to ask themselves whether property taxes apply to them in light of this. By contrast an organization that is incorporated under the Canada Business Corporations Act is generally referred to as a business corporation.

Not-for-profit corporations are not automatically considered registered charities or non-profit organizations for. 68123 USD 67130 CAD Executive Directors work closely with the Board of Directors and are ultimately responsible for the day-to-day operations of the organization including their financial programmatic and developmental success. For nonprofit organizations tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade.

Even though not-for-profits dont pay income tax the requirement to file a tax return has been in place since 1993 and penalties exist for late filing. Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes. Do nonprofits pay taxes in canada Tuesday February 22 2022 Edit.

Find more information at About alternate format or by calling 1-800-959-5525. For employees nonprofit organizations have to withhold income taxes withhold and pay social security and Medicare taxes and pay unemployment taxes on wages paid to employeesiv Generally organizations do not have to withhold or pay any taxes on payments to independent contractorsv However if four conditions are met an employer must generally. Additionally Canada recognizes a statutory list of organizations which are not technically charities but which are treated as such for the purpose of.

NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax Act. 6 Key Nonprofit Jobs.

Pin On Infographics Pin On Luxe Accounting Tax Services What Are The Private Public And Nonprofit Sectors And Which One Is Right For You Ie School Of Global Public Affairs. The standard Personal Allowance is 12500 which is the amount of income you do not have to pay tax on. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for. Tax time can be stressful for nonprofit and charitable organizations in Canada especially when the filing requirements are not well understood within the organization. Property Taxes Non-Profits By CED Guest Author Published September 16 2014.

There are some instances when nonprofits and churches are still required to pay taxes. Nonprofit organizations are exempt from federal income taxes under subsection 501 c of the Internal Revenue Service IRS tax code. However as an employee of the institution the professor is required to pay tax on his or her income and benefits despite the fact that the endowment payout to the non-profit institution is free.

This exemption applies only to income tax.

Do Nonprofits Register For A Tax Id In Canada Ictsd Org

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Canadian Incorporation Nonprofit Charity Etc

Do Churches Pay Hst In Ontario Cubetoronto Com

Do Nonprofit Organizations Pay Property Taxes In Canada Ictsd Org

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

Complete Guide To Donation Receipts For Nonprofits

Npo Non Profit Organization Overview And Requirements

Do Nonprofit Organizations Pay Taxes In Canada Ictsd Org

Does A Nonprofit Organization Have To File Taxes In Canada Ictsd Org

Canadian Incorporation Nonprofit Charity Etc

Do Nonprofits Pay Taxes In Canada Ictsd Org

Does Us Nonprofits Pay Taxes In Canada Ictsd Org

Start Build And Grow A Social Enterprise Start Your Social Enterprise Business And Industry

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)